The recent report by the American Accountability Foundation (AAF) on the University of Texas/Texas A&M Investment Management Company’s (UTIMCO) asset managers is alarming. According to the report, UTIMCO’s asset managers cast 159 proxy votes in support of radical, politically motivated proposals that are counter to the spirit of Texas and federal laws.

These findings reveal that UTIMCO’s fund managers have been supporting initiatives in favor of Environmental, Social, and Governance (ESG) and Diversity, Equity, and Inclusion (DEI) resolutions, as well as anti-fossil fuel policies aligned with international agreements like the Paris Accord but not with state law. This is more than just an ideological shift—it’s a betrayal of UTIMCO’s fiduciary duty to prioritize the financial well-being of Texans over political agendas.

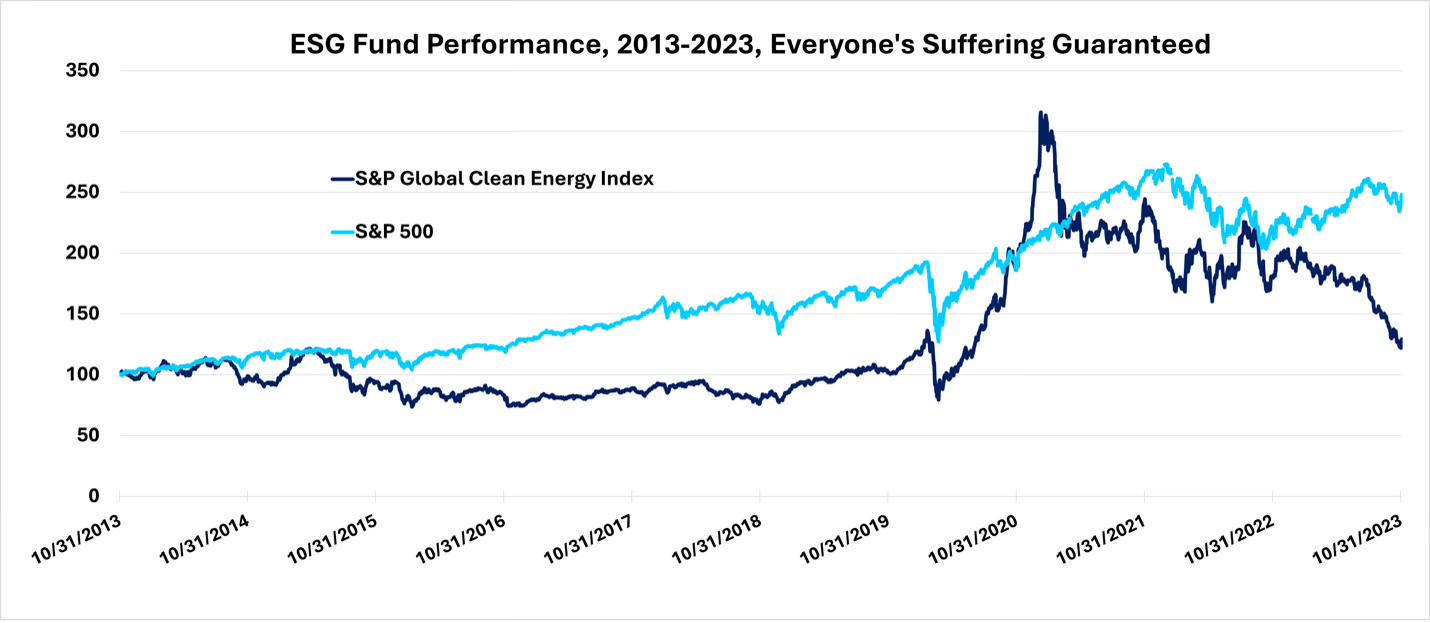

For too long, ESG investing has been presented as a harmless, even noble, strategy for ensuring corporate responsibility. But as the AAF’s report shows, the reality is much darker. The ESG movement has become a political weapon wielded by financial elites to enforce progressive social and environmental goals at the expense of industries that are critical to both Texas and the American economy, particularly oil and gas.

It’s no secret that Texas is the heart of America’s energy industry and a powerhouse for job creation, economic stability, and national security. Yet UTIMCO’s institutional fund managers voted to support anti-oil and gas policies that seek to wreck our economy, all in the name of ESG and so-called climate goals. This directly harms the very industry that sustains a significant portion of our state’s budget, not to mention the lives and livelihoods of millions of Texans.

The AAF report also highlights how UTIMCO’s asset managers have backed initiatives that laughingly claim to address climate change.

Consider Europe, where overreliance on renewable energy has led to skyrocketing energy costs and forced many countries to revert to coal and natural gas just to keep the lights on. In Texas, we’ve witnessed the dangers of an electricity market distorted by subsidies, which have left the energy capital of America overly dependent on foreign-made, variable energy sources. During the 2021 winter storm, this over-reliance led to power outages across the state when these unreliable sources failed to deliver.

Yet UTIMCO’s asset managers are aligning with these radical policies, ignoring the vital role fossil fuels play in both our economy and daily lives. Their votes are not just anti-Texan—they’re anti-reality. Fossil fuels power 80% of the nation’s electricity and are essential to manufacturing, transportation, and even the production of renewable energy infrastructure itself. The fantasy of a net-zero economy, driven by unreliable renewables, is not only unattainable, it’s also reckless.

One of the most egregious aspects of the report is UTIMCO’s support for policies aligned with the Paris Agreement. This international climate accord has no legal authority over the United States and was rejected by the previous administration for its overreach and detrimental impact on American energy independence.

It’s worth remembering that China, one of the largest polluters in the world, is given a free pass under the Paris Agreement to continue expanding its coal plants and increasing emissions of both harmful pollution and greenhouse gases. Meanwhile, American companies, particularly in Texas, are being hamstrung by regulations that make it harder to produce energy domestically. This is a gross injustice to the American people, and it’s shocking that UTIMCO’s fund managers would support such a framework.

What this report ultimately reveals is a larger, more systemic problem: the ideological capture of financial institutions that manage billions of dollars of public money. Texans have every right to be outraged that their tax dollars are being used to support political agendas that run contrary to their values and economic interests. The AAF’s findings highlight a troubling trend where fiduciary duty is cast aside in favor of virtue signaling and adherence to globalist ideals.

UTIMCO’s asset managers have an obligation to maximize returns for their clients, not to push radical political agendas that jeopardize the state’s economic engine.

Texas cannot afford to let woke corporate policies drive investment decisions that should be rooted in financial responsibility. The Texas Legislature has already made strides in addressing this issue with laws like SB 13, which prohibits state contracts with financial institutions that boycott fossil fuels.

The institutional fund managers who voted in favor of ESG-related resolutions must be held accountable. Their actions have undermined the financial well-being of Texas and supported agendas that directly conflict with our state’s values and priorities. Texas cannot continue to do business with institutions that actively work against our economic interests. As such, UTIMCO should cease doing business with these fund managers, which should also be placed on the Texas energy boycott list, alongside other companies that seek to harm our vital energy industry. It’s time to put an end to the woke corporate overreach and ensure that Texas remains strong, free, and energy-independent.

This article was first published on Jason Isaac - Liberate America’s Energy